Interest Rate Update ~ December 2021

2021-12-09 | 03:58:12

The Bank of Canada announced today that they are leaving the overnight rate, which influences the bank’s prime rate for variable rate mortgages, at its current level for now. However, with inflation increasing there is a strong possibility that the prime rate will start to creep up in mid 2022. It is especially important to remember that inflation is measured in a year-over-year basis, so while the inflation rate sounds high right now, we are comparing current economic activity to mid-Covid lockdown economic activity. We are actually still below the levels of inflation from the late 2019 pre-pandemic period.

So, the question is: Should I lock in from my variable rate mortgage to a fixed rate mortgage?

I would put the chances of me EVER recommending someone change from a variable rate to a fixed rate as extremely low.

Scotiabank received a lot of coverage last month saying that rates could go up 2% over the next 2 years, but they were an outlier. Most economists are predicting a 0.50% - 1.00% increase over the next 24 months, nowhere near enough to make it attractive to lock in. And there are more than just the monthly interest costs to consider.

I started working with a client recently who chose a fixed rate 1.5 years ago. He has since lost his job and is moving back to the United States. Mortgage amount = $501,505.56. Penalty if he had gone variable = $1,878.65. Actual penalty because he went with a 5-year fixed rate = $35,807.50. I have seen other examples of homeowners getting caught by large penalties on fixed rate mortgages. This reminds me of a quote I heard years ago at a conference: “Life is variable, so your mortgage should be too.”

So, it may be slightly possible (but highly unlikely – history shows that you are better staying variable over 90% of the time) that you might save a few dollars a month for a short period of time over the next 5 years by converting to a fixed rate. There is ZERO chance that the penalty will make up for that. And over 60% of Canadians do not finish a 5-year fixed term.

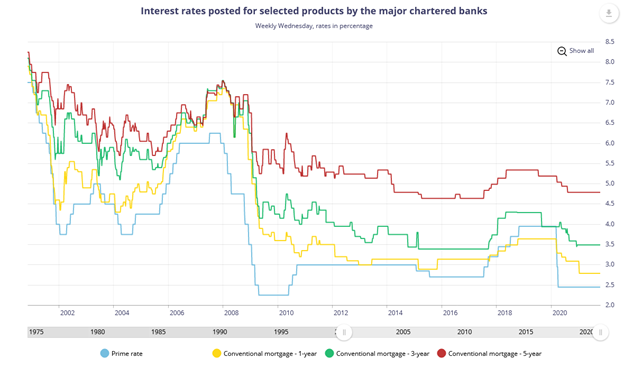

We have never had a period where rates went up and either continued to climb or held steady for 5 years straight. They always come back down. And each time in the last twenty years when we heard ‘rates are going up significantly for a long time’ (2002 / 2005 / 2007 / 2010 / 2017) the doomsayers were wrong (see the blue line on the graph below).

Play the odds – stay variable.

***Disclaimer: if you are going to lose sleep over it, just lock in --- but I am certain that you will pay more over the long haul.

As always, if you have questions please feel free to give me a call at 905-299-4665. I'm happy to help.

Thanks, ...Patrick.