Economic Update ~ December 2022

2022-12-07 | 10:10:30

It is no secret to anyone reading this: The Bank of Canada is acting far more aggressively than anyone expected. Several unpredictable issues are at play: the war in Ukraine, supply chain issues worldwide, and good old corporate greed. Back on September 7th, the Bank of Canada announced a whopping increase of 0.75% and another 0.75% in October, and a further 0.50% today, leaving many economists scratching their heads. The Prime Rate at the major Canadian banks now sits at 6.45%. Typically rates increase or decrease by 0.25%, if they change at all. Inflation has forced the hand of the Bank, but their track record of acting this strongly is downright dismal. For each of the last 5 rate increase cycles, the Bank of Canada had to reverse course within 18 months. They never have the patience to wait to see the downline effects of their actions.

Question #1: How high will rates go?

After today’s announcement, most experts agree that there is no reason to raise rates any higher. Experience shows us that interest rate changes cannot fully affect the economy for 6 – 18 months. The smart thing to do now would be to take a pause and monitor inflation over the next year.

Question #2: Will rates come back down?

The short answer is yes, rates will most certainly come back down. Look to the past and you will see that we have been here before: rapidly rising rates always results in declining rates at one point or another. Some experts believe we could see rates drop in mid-2023, if not sooner. The following two charts help explain:

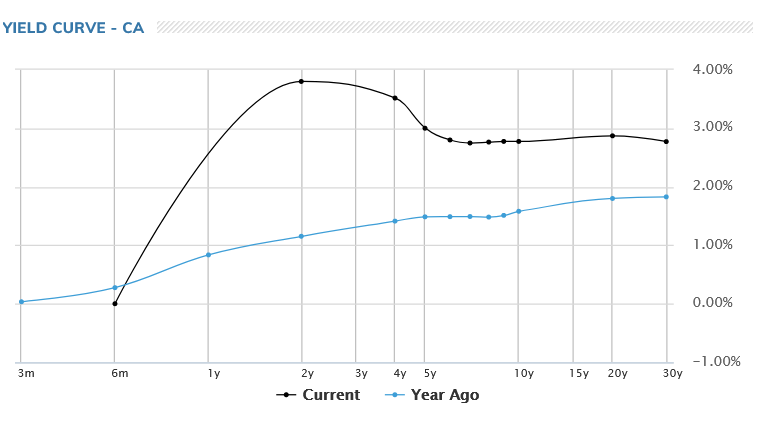

a/ We have the largest difference between the 2 and 10 year bond yield since 1981. You would normally expect the 10 year bond to have a better return for investors than a 2 year bond. When it is the other way around, like it is today, it is called an inverted yield curve. This is the clearest sign that the markets are expecting lower interest rates in the future.

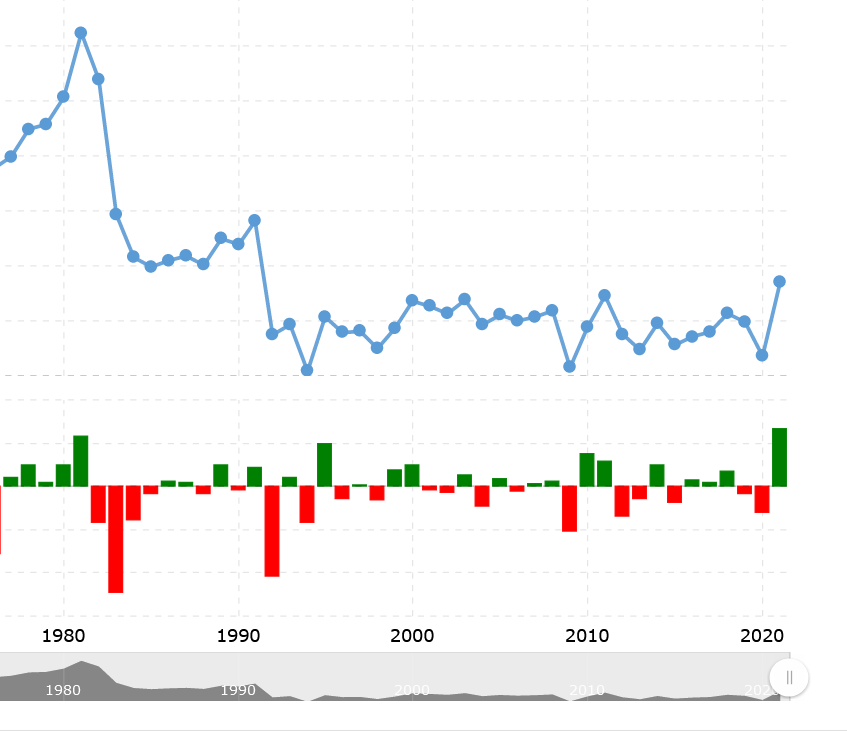

b/ Let’s see what happened to inflation (the blue line) the last time their was this large of an inversion of the 2 to 10 year bond yields in 1981:

That is right, the bond market predicted lower rates, just like it is now. Inflation and interest rates dropped off quickly and stayed relatively low for almost 8 years.

Question #3: Should I lock into a fixed rate?

I totally get why this might be tempting. Who wouldn’t want a mortgage product that offers certainty in uncertain times? The reality is that short term thinking has long term consequences. Locking into a 5-year fixed rate at over 5% or higher may seem attractive now – but I assure you it will be a lot less attractive over the next few years of your term when rates inevitably plummet, which not only costs you more in interest, but could potentially mean tens of thousands of dollars in penalties if there is ever a need to get out of your mortgage because of the tricky ‘interest rate differential’ penalties. Nobody plans to get out of a mortgage before the term is up, but statistics have shown that over 50% of Canadians do not finish a 5 year fixed rate term.

I know firsthand that it is not fun to be holding a variable rate mortgage right now, but I assure there is light at the end of the tunnel. Hold the course and expect lower rates sooner rather than later.

If your mortgage is up for renewal in 2023, or you know someone who’s is, please reach out to me to discuss a renewal strategy to help lower your interest costs. It is my goal to always look out for your best interest.

I always appreciate your time and your trust.

Many thanks,…Patrick